Do I Need Collision Coverage In My Auto Insurance Policy?

How Does Collision Coverage Work?

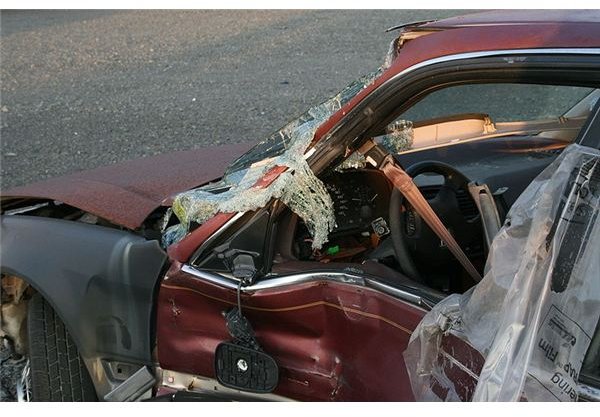

You may ask yourself, “Do I need collision insurance on my car and what is it exactly”, simply put collision insurance covers the costs to repair damage to your vehicle that results from an accident which you caused. Collision coverage is a very common part of most auto insurance policies and if you are in an accident which was another driver’s fault, then that driver’s insurance will cover the repair costs of your vehicle.

Total Loss

Collision coverage may also pay to replace your damaged vehicle. If the estimated cost to repair a damaged vehicle is close to what its appraised value was prior to an accident, then insurance companies will declare the car a total loss, or total the car.

The insurer will take the damaged car and sell its parts to a salvage business. The insurer will issue the insured driver a check equal to the prior appraised value of the totaled vehicle. The driver can use the insurance money to buy a replacement vehicle.

Collision Limits

Collision insurance is sold with two coverage limits. A deductible is the maximum amount that a driver must pay out of his own pocket before the insurer will begin paying collision claims. The total coverage limit is the maximum amount that the insurer will pay to repair or replace the vehicle after the driver has paid his deductible.

If a driver has a $500 deductible and a $100,000 coverage limit, then the driver will need to pay $500 to repair damage before the insurer even pays a penny. A driver’s collision insurance premium will increase when the driver increases his total amount of coverage or when the driver decreases his deductible.

Is Collision Required?

Collision coverage is not legally required for all drivers. If you take out a loan to purchase a car, the lender may require you to maintain collision coverage as a condition of your auto loan. Financial institutions that lease vehicles may also require collision coverage as a condition of an auto lease.

Most car owners would be wise to purchase collision coverage for their vehicles, especially owners of newer vehicles. As the appraised value of a used car goes down, a point will be reached where it would be cheaper for the car owner to drop his collision coverage. The car owner without collision coverage would replace his used car if he causes an accident that leaves him with high estimated costs of repair.

Many car owners use $4,000 in appraised value as a reference point when deciding whether or not to maintain collision insurance. As soon as a car’s value drops below $4,000, many car owners drop their collision coverage.

Resources

autoinsuranceindepth.com, https://www.autoinsuranceindepth.com/optional-coverages.html

carinsurance.com, https://www.carinsurance.com/CoverageDefinitions.aspx

Image Source

Wrecked Car. (Supplied by Ildar Sagdejev at Wikimedia Commons; GNU Free Documentation License; https://upload.wikimedia.org/wikipedia/commons/2/23/2008-07-23_Wrecked_car_in_Durham_2.jpg)

This post is part of the series: How Does Auto Insurance Work?

Learn more about auto insurance. Get some helpful hints and find out how auto insurance can work for you.