Analyzing the Matching Principle With Step-By-Step Examples and Explanations

The Significance of Matching Principles in Accounting Transactions

GAAP rules require that expenses recognized as deduction to annual income should be recorded on the date that the expense was used to produce the income. The matching principle in accounting is also applicable to income that is received in advance but should be recognized only if the goods have been delivered or the services rendered.

The IRS carefully scrutinizes expenses and the methods employed in reducing the taxable income. On the other hand, the SEC reviews not only the income and expenses, but the entire financial position. A company’s income should match its resources or assets, while the matter of operating mostly on borrowed funds will be considered as alarming.

The IRS is concerned about overstatement of expenses and understatement of income while the SEC will assess claims of excellent business performance and sound financial condition.

Basically, the accounting method often used to take up the necessary entries that can effectively carry out the matching principle in an entity’s books of accounts is the accrual method of accounting.

In this article, however, our focus specifically pertains to the income and expense matching principle. The objective is to provide a comprehensive explanation as to the possible conditions that bring about the mismatches, which could substantially affect an entity’s actual income or real financial position.

In order to stay organized, we will make use of the accounts presented in the article <em>Sample</em> <em>Unadjusted Trial Balance Worksheet</em>, inasmuch as the matching of revenues and expenses is usually taken-up at year’s end. Click here to see an image of a Sample Unadjusted Trial Balance Worksheet.

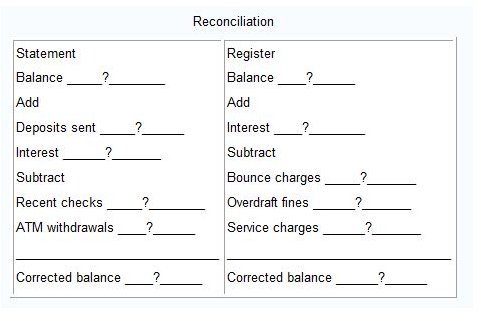

Cash – Consider the Reconciling Items of Bank Statement Reconciliation

If we are to closely examine the cash account, a review of the bank statements will reveal several reconciling items between the Cash in Bank balance per books vs. the Cash in Bank balance per bank statement. These items include charges by the bank but are still not reflected in the entity’s books of accounts. Usually, these reconciling items include bank charges for the cost of checkbooks, for bank overdraft or service charges for special bank services, as well as the interest income and its corresponding withholding taxes.

In such cases, there is no need to accrue the reconciling items that affect the expenses or income since these were already debited or credited to the entity’s bank account beforehand. The mere recognition of the income or expenses by way of accounting entries will suffice. These entries will rectify the entity’s actual Cash in Bank balance whilst matching income and expenses at the same time.

Example of Accounting Entries - Bank Reconciliation Items

(1) To record the bank charges deducted by the bank from the bank deposit not taken-up per books:

Dr. Bank Charges __________ $xyz

Cr. Cash in Bank __________ $xyz

(2) To record the income earned on bank deposits not yet taken-up per general ledger books

Dr. Cash in bank __________ $xyz (Net of withholding Tax)

Dr. Taxes Paid __________ $xyz

Cr. Income Earned on Bank Deposit __________ $xyz

However, these items were transactions that transpired up to November only.

Consider that the books will be closed to all transactions come December 31, while the bank statement for the month of December will be sent over by the bank on January of the next year. The entity may take-up an estimated amount as accrued expenses and unearned income if the effect of non-inclusion will greatly impact the financial statement presentation for the current year.

We will proceed to the operating expense accounts since the explanations and examples to illustrate the matching principle for Merchandise Inventory and Prepaid Insurance are already presented in another article Examples of Post-Adjusted and Post-Closing Trial Balances.

Salaries & Wages: Consider the Employer’s SS & Medicare Contributions

Inasmuch as December salaries and wages will be paid at month’s end, the corresponding taxes, Social Security, and Medicare contributions have been withheld from salaries and are recognized as payables. They will be remitted on January of the following year.

The bookkeeper’s concern will be the recognition of the employer’s correlated contribution, which should be taken up before the closing of the books at year’s end and not in the following month when actual remittance is made.

Leaving this unrecognized as expense for the year, particularly if the company has substantial payroll amounts, may result in under-deduction of expenses against income. The IRS may ignore this because the business is bound to pay higher taxes, but the SEC may not, because this is an overstatement of income.

Hence the following accrual entries should be included among the adjusting entries in the post-closing trial balance worksheet.

Dr. Social Security-Employer’s Contribution (Dec.) __________ $xyz

Dr. Medicare-Employer’s Contributions (Dec.) __________ $xyz

Cr. Social Security-Employer’s Contributions Payable __________ $xyz

Cr. Medicare-Employer’s Contributions Payable __________ $xyz

Come January, and upon actual payment of all Social Security and Medicare contributions recognized in the December payroll, the accounting entry will include the reversal of the accrual account Employer’s Contributions Payable for Social Security and Medicare. The accrued expenses adjusting entries entered before the books were closed in December already recognized the expenses in order to match income for the year.

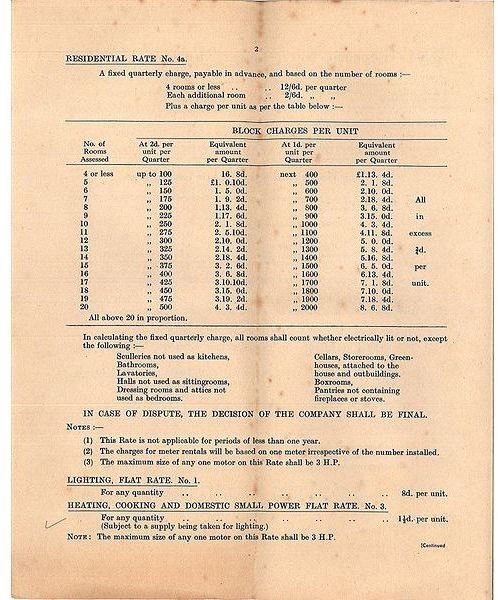

Utilities Expense & Telephone & Communication Expenses

Most utility bills are paid on the following month, because billing statements are received at month’s end. However, since we are in the process of closing the books of accounts for the current year and the costs of the utility bills are quite substantial, it is important that they are taken-up as adjusting entries in the year-end post-closing worksheet.

The related adjusting entry would be:

Dr. Utilities Expenses __________ $xyz

Dr. Telephone & Communication Expenses __________ $xyz

Cr. Accrued Utilities Expenses Payable __________ $xyz

Cr. Telephone & Communication Expenses Payable __________ $xyz

Similar expenses like Rent Expenses, Janitorial Services, and Security Services, among others, will basically be treated using the same methodology. If all these expenses are not recognized before the books are closed at year’s end, the accumulated total could create a significant distortion in the company’s financial statement.

Capitalization of Costs as Example of Matching Principle

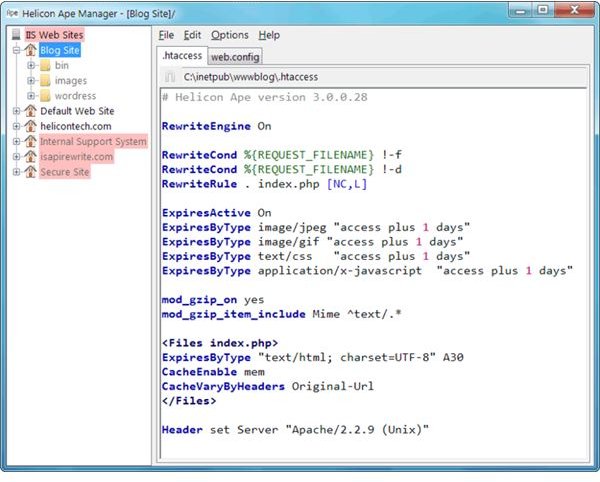

The principle of matching revenues and expenses is also the basic guideline in determining if the asset or major expense should be capitalized or not. The concept of future years’ benefits means the acquisition cost will spread out through the entire life of the asset by way of depreciation expenses. This way, the amounts of annual depreciation as expenses related to the generation of income during the year becomes properly matched.

Capitalized web development costs include only the costs paid for domain name as well as the costs of software development including installation, testing, and upgrading costs. These expenses are expected to give future years’ benefits; hence their costs are amortized throughout the estimated number of years prescribed by a standards board.

However, certain expenses are best recognized as immediate expenses if their costs will in turn match what is considered as ordinarily incurred as part of day to day operations. A $20 trashcan may have a useful life, which could serve in terms of future years’ benefits but does not pass the substantiality test or the principle of cost to economic benefits.

Hence, in determining the application of matching principles, the bookkeeper’s complete knowledge of all other basic accounting principles will serve as a further guide in making the right accounting decisions.

Reference Materials and Image Credit Section

Reference Material:

- Accrual Accounting and Adjusting Entries from MoneyInstructor.com

Image Credits: