Easy Tips on Writing Off an Uncollectible Account: Using the Direct Write-Off Method

Overview

Every company has good intentions of having its receivables collected on a timely basis. While it’s a great idea to get all of them collected, a company must realize some credit sales may be hard to collect and turn into a bad debt. An uncollectible account refers to a potential loss in proceeds that enables the assets, stockholders’ equity, and income to decrease. So what’s the process for writing off an uncollectible account and when should you consider the receivable a bad debt?

There are two methods for recording bad debts, which are the direct write off method and the allowance method.

The direct write off method includes recording the bad debt as an expense once you have decided the payment is impossible to collect. The allowance method considers uncollectible accounts from all sales and are placed as an expense within the accounting period based on an estimation made of the expected uncollectible amounts. Nevertheless, this article covers and concentrates on the writing off method.

When and How to Write Off

Some indications leading to bad debt write offs include:

- A debtor has applied for bankruptcy and the bankruptcy court decides you would get nothing or little on the receivable.

- Losing in a litigation that includes an accounts receivable.

- The collection agency returns delinquent accounts receivables as uncollectible.

- Your accountant or attorney suggests it is useless to sue the debtor.

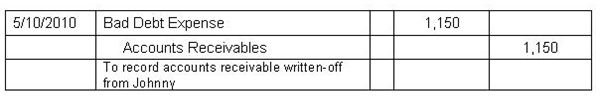

Before performing the direct write off technique, make sure you have actual figures, not estimations. You can remove a specific accounts receivable from the accounting records at the time it is eventually uncollectible. Once an account is considered uncollectible, you can make an entry by debiting Bad Debt Expense and crediting Accounts Receivables.

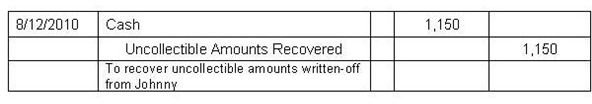

If the debtor eventually pays the debt, but the account was formerly written off, you will need to debit Cash and credit Uncollectible Amounts Recovered on your accounting records.

Despite being easy and simple in practice, keep in mind you can only apply this technique when the amount uncollectible is immaterial. An account is determined to be material when it is large enough to influence interpretations of the financial statement. However, being material or immaterial depends on the company’s decision.

Conclusion

You might find this method of writing off an uncollectible account inadequate as it cannot match costs with revenues over a period of time. As you know, costs associated with revenues must be reported during the same period, this technique poses a few of disadvantages for a company. Costs on the financial statement might not reflect the real expenditures during a specific period because bad debt expenses can occur in any previous period.

In other words, revenues from credit sales might be recognized in a specific period, but the costs of uncollectible accounts associated with these sales may be unrecognizable in that period. You might instead recognize these costs in the next period. It means the method raises a discrepancy in costs and revenues. In addition, it prevents receivables from being recorded at an estimated value on the balance sheet.

References

Kieso, Donald E., Weygandt, Jerry J., & Warfield, Terry D. Intermediate Accounting, 12th Edition. John Wiley & Sons, Inc. (2007, December)

Petroff, John. “Chapter 9: Receivables” https://www.peoi.org/Courses/ac/ac9.html

Policies and Public Rules: Write Off of Uncollectible Accounts Receivable - https://www.kingcounty.gov/operations/policies/aep/financeaep/fin113ap.aspx

Screenshots courtesy of author.