The Uses of Moving Average Inventory Cost Method: Explanations and Illustrated Example

The Basics of the Moving Average Inventory Cost Method

Point of Sale (POS) accounting software has the capability to calculate average cost per unit in its inventory costing system, since it is one of the four cost flow assumptions recognized by GAAP. However, the Internal Revenue Service (IRS) basically recognizes only the First-in First-out (FIFO) method.

This information tends to confuse an accountancy learner, who would be interested to know who uses the moving average inventory cost method and how users apply it.

First, this method does not take into account the actual purchase prices of the goods held as inventory. It is also known as the “rolling average inventory cost method” or “weighted-average cost method,” because the different unit costs will be considered based on the quantity they represent. After this, the sum of all purchase costs will be divided by the total quantity of the inventory on hand.

To illustrate:

Item (1) 50 units @ $100/unit; Item (2) 50 units @ $ 115/ unit; Item (3) 100 units @ $110/unit

Sum of all purchases = (1) $ 5,000 + (2) $ 5,750 + (3) $ 11, 000 = $ 21,750

Sum of all units or total quantity = 50 units + 50 units + 100 units =200 units

Weighted Average Inventory Cost per Unit = $ 108.75/unit

The calculation of weighted average costs of the stock held as inventory applies each time there is a transaction or movement in stock supply–hence the term moving average inventory cost method.

Image Credit: [Culinary Specialist 3rd Class John Smith uses the existing DOS-based](https://commons.wikimedia.org/wiki/File:US_Navy_110129-N-7676W-152_Culinary_Speciali st_3rd_Class_John_Smith_uses_the_existing_DOS-based_food_service_management_system aboard_the_aircraft_.jpg) …. Wikimedia Commons_

Understanding the Uses of the Moving or Weighted Average Inventory Cost

In understanding the use of this average cost method, there are two conditions to consider:

-

The business uses the perpetual inventory system, which requires the constant monitoring of the weighted average cost per unit at every sale and purchase.

-

The business procures, stores, and sells fungible products that physically flow and comingle with the inventory items already kept in store, which makes it impossible to differentiate which portion of the inventory stocks were first or last brought in.

Based on these specific conditions, it can be deemed that the users of the moving or weighted average inventory cost method are:

1. Businesses like grocery stores, supermarkets, and department stores that maintain large inventory of merchandise for resale, comprising different items in multiple variations

2. Businesses engaged in the production or purchase and retailing of petroleum, oil, crude, gas, natural gas, and all their derivatives, or what are described as fungible items

After knowing its use and who utilizes this method of calculating inventory costs, the following sections discuss how it is applied in actual business systems.

Image Credit: Wegmans Cash Register - Wikimedia Commons

Businesses with Large Inventory Comprising Different Items in Multiple Variations

Retail outlets like grocery stores or supermarkets frequently purchase goods in large quantities for purposes of reselling in smaller units or quantities, to which the use of the perpetual inventory system is the most practicable method of monitoring various unit costs per item.

A large department store, as an example, maintains an inventory of different dry goods from clothing, shoes, home furnishings, accessories, toys, and cosmetics, just to name a few, which also come in various sizes, colors, styles, and brands. In today’s present business accounting system, any item sold is automatically deducted from the inventory count, as each transaction is taken-up by the cashier’s computerized cash register.

-

The cash register records each sales transaction through POS (Point-of-Sale) software, which automatically feeds data to other software modules including the unit that maintains the perpetual inventory system.

-

In every movement, i.e. sale and purchases that are recorded under this inventory system, the average cost per unit of all merchandise currently held as stock inventory will be automatically calculated by the computerized system.

-

However, the average cost per unit will be utilized as a basis for in-house reportorial purposes only, for determining the appropriate selling prices, inventory levels, or for gross profit margin monitoring.

-

The Internal Revenue Service (IRS) does not allow the use of the moving average inventory costing method for taxation purposes, as per Treas. Regs. section 1.472-(d).

Image Credit: Product screenshot Wikimedia Commons

Kindly proceed to the next page for explanations on how the said method is used by businesses that trade in fungible items like petroleum.

Businesses Engaged in the Production or Purchase and Retailing of Fungible Items

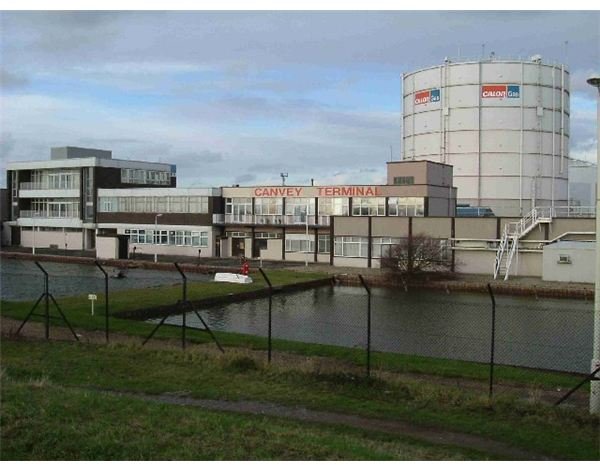

We all know that petroleum, gas, oil, and its derivatives are stored in large quantities and quantified in terms of barrels. These products are described as fungible because their molecules freely combine with the rest of the stored supply, in which the process of distinguishing the old from the new would be impossible.

The IRS allows average costing for these fungible items since the goods do not meet prescribed conditions stated in Treas. Regs. Section 1.472-(d)

Bear in mind, however, that the physical characteristics of the product as a free-flowing and co-mingling substance is not the IRS’s sole criterion for allowing a business entity to use the moving or weighted average costs. Business operators who deal with fungible goods will find it necessary to consult with the IRS when making decisions about the type of inventory costing method to use.

The tax agency also takes into consideration the volatility of the product’s price, the volume, and the material difference that the method would create for taxation purposes.

Image Credit: Canvey Terminal - geograph.org.uk _98277. Wikimedia Commons

Illustrating and Explaining the Moving Average Inventory Cost Method

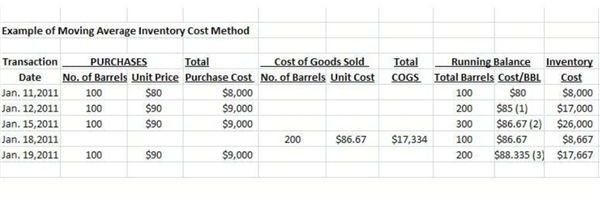

Study the image on your left which is a screen-shot of an inventory worksheet for petroleum. (Kindly click on the image in order to get a larger view)

The average cost of petroleum per barrel (bbl) is reflected under Column I; take note of the reference numbers for which the following sample calculations were made in order to arrive at the cost per barrel:

(1) Total No. of BBL = Jan. 11 100 bbl + Jan. 12 100 bbl = 200 bbl as of Jan. 12, 2011

Total Cost of Purchases = Jan. 11 Purchase $8,000 + Jan. 12 Purchase $9,000 = $17,000

Average Inventory Cost per Barrel = $17,000 / 200 bbl = $85 per barrel as of Jan. 12, 2011

Image Credit: Illustration of of Inventory Worksheet for Petroleum by author cscantoria

(2) Total No. of bbl = Jan. 11 100 bbl + Jan 12 100 bbl + Jan. 15 100 bbl = 300 bbl as of Jan. 15, 2011

Total Cost of Purchases = Jan. 11 $8,000 + Jan. 12 $9,000 + Jan. 15 $ 9,000 = $ 26,000

Average Inventory Cost per Barrel = $26,000 / 300 bbl = $86.67 per barrel as of Jan. 15, 2011

(3) Total No. of bbl = Total as of Jan. 15 100 bbl + Jan. 19 100 bbl = 200 bbl as of Jan. 19, 2011

Total Inventory Cost = Jan. 18 $8,667 + Jan. 19 $9,000 = $17,667

Average Inventory Cost per Barrel = $17,667 / 200 bbl = $88.335 per barrel as of Jan. 19, 2011

For purposes of comparison, let us determine the amount of cost of goods sold (COGS) using the FIFO method and compare it against the COGS using average costs.

Jan 18, 2011 Sale of 200 bbl

FIFO Cost of Goods Sold = (100 bbl x $80) + (100 x $90) / 200 = $8,000 + $9,000 = $17,000

FIFO Cost of Goods Sold = $17,000 while Cost of Inventory as of Jan. 18 = $9,000

Average Cost = Cost of Goods Sold = $17,334 while Cost of Inventory as of Jan. 18 = $8,667

In studying this comparison, it appears that the use of the average cost method generates a higher amount of cost of goods sold, since part of the costs imputed is the differential cost between the purchase prices at $90 / barrel versus the $80/ barrel.

Technically, this is a near accurate computation of the actual costs, inasmuch as the petroleum purchased on Jan. 11,12, and 15 had already co-mingled, and it could no longer be distinguished which of the purchases came in ahead.

Image Credit: Fuel Barrels - Wikimedia Commons

Summary:

As a summary, large retailers like supermarkets, department stores, and grocery stores use the moving or weighted average cost method for reportorial and other in-house purposes only, as a means for facilitating cost and financial analyses in real time, but not for determining the taxable income.

Businesses that trade in large volumes of oil, petroleum crude, gas, natural gas, and these products’ derivatives make use of the moving average inventory cost for their financial statements and tax returns for as long as the effect is not material.

Reference:

The sample worksheet and explanations were created by the author for this article.